Why is the VIX so low, what's driving it, how low can it go, and for how long? Part 1 - The Setup

The 4 questions on all option traders' minds today

I wanted to write a post on these 5 questions which are dominating the minds of all options traders today (especially equity options traders, but also in the world of foreign exchange, interest rates, commodities, credit, and cryptocurrencies as options markets have become increasingly intertwined over time).

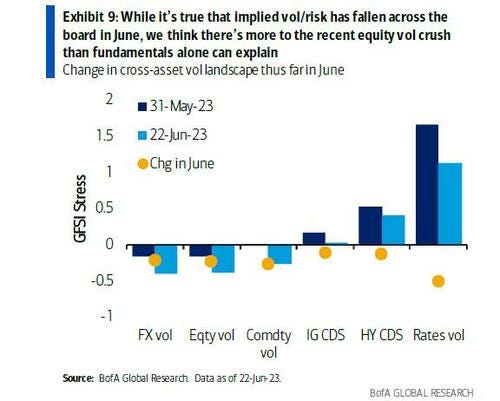

Volatility across markets has fallen in June, both realized volatility and implied volatility, as can be seen from this chart by Bank of America:

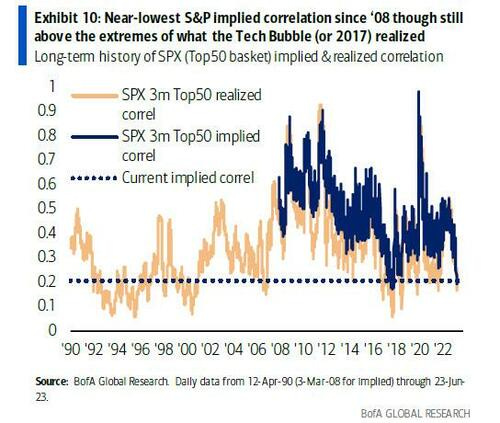

As I wrote in an earlier post, this is especially pronounced in the equity index options market because both implied correlation and realized correlation in equity indices (and the US S&P 500 in particular) have reached multi-decade lows. Here is another good chart from Bank of America that shows the 3-month implied correlation and 3-month realized correlation of the top 50 stocks (by market capitalization) in the S&P500 going back for multiple decades to get a sense of where we are on the correlation front. When correlations are low within the equity index, equity index volatility is especially low relative to the constituent single stock volatilities.

As you can see, the blue dotted horizontal line as well as the orange line show the low levels we are at in June 2023 (around 20%). Also, as I mentioned in the earlier post, a lot of hedge fund traders would like to bet on both realized and implied correlation to mean revert to higher levels, as has happened historically, and it would seem that they have loaded up on these correlation trades in the past couple of months. However, this seems to be a catch the falling knife type of trade, as the magnitude and speed of the move have probably caught some of the early buyers off-guard and resulted in drawdowns in their P/L.

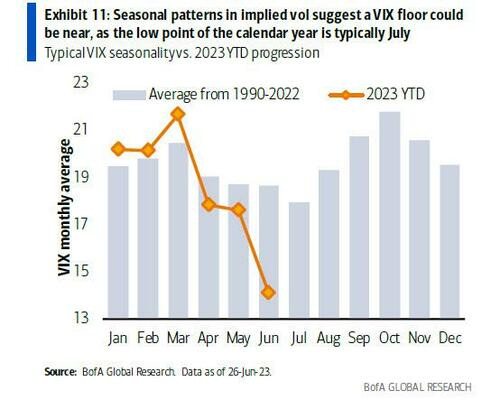

All traders care a lot about seasonality (over the trading year), and after many years of trading a few patterns often come to mind:

January: P/L resets to zero, time to add fresh positions, often results in volatility and risk assets to perform as investors start ‘loading the boat’ with their favorite assets.

Summer: Investors are ready to de-risk their portfolios and enjoy some highly-needed vacation! Some volatility due to de-risking activity and a potential retracement in underlying asset price action, followed by a lull in volatility during the summer months.

Fall: Back in their seats, portfolio managers are looking to close out the year with a strong finish, putting trades back on (and potentially swinging for the fences if they are lagging their peers or benchmark!) Expect increased volatility.

December: Time to de-risk again ahead of the Christmas holidays, and similar price action as early summer can be expected. However, sometimes options market-makers over-discount the level of volatility over the last couple weeks of the year and get caught short gamma in a low liquidity market, causing volatility to spike in a reflexive loop.

The following chart shows that this trader’s intuition tends to show up in the long-term data, and the yellow line shows how far of a deviation this June has been:

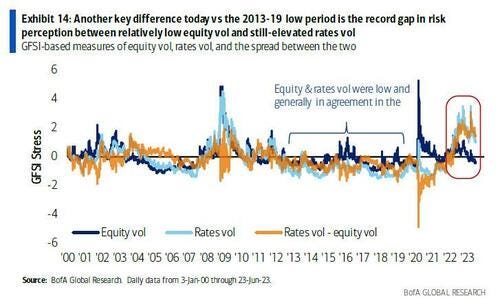

The last chart below shows that we are currently seeing unprecedented levels of divergence between equity volatility and rates volatility (the gap between the light blue line and the dark blue line below, or the high level in the yellow line, which represents the spread). As mentioned in my post about trading cross-asset volatility, typically there is a generalized level of risk premium across markets that tends to cause vol to trade more or less in lockstep across asset classes. It is interesting to note that this divergence is extreme even when taking into account the fact that SPX correlation has fallen to current levels during this time period (in 2007 and 2017-2021 as can be seen in the 2nd chart of this post).

This was a lot to digest! I am happy to answer any questions, and in Part II I will describe some potential trades that options traders can make to take advantage of this, as well as their downside risks.

For readers who would like to send us a tip and remain free subscribers for now, we have a tip jar at www.buymeacoffee.com/optionsnerds - Thanks for your support!