What is the Black-Scholes formula and why do option traders use it? Part 1 - History and Purpose

Level 1 - Zero to Options Hero - A quick dive into financial history - the Black Scholes formula, and why it is used to this day.

Purpose

The Black-Scholes formula is a function that can calculate the value of a call or put option (or option premium) given a set of known parameters (also referred to as inputs). These are the current price of the underlying asset, the option strike, the time to maturity, the implied volatility of the option, and the risk-free interest rate.

The formula is used as a benchmark tool by options traders around the world in various markets because it is easy to compute, and also the sensitivities of the option’s value to each of the inputs are also easy to compute. Since the options market rapidly developed in the 1980s when computational power was far less developed than now (see Moore’s Law), the Black-Scholes formula rapidly became the market standard that options traders used to ‘talk to each other’ quickly about the prices they were willing to buy and sell at.

Since underlying stock or other asset prices tend to be more volatile than option implied volatilities, it is preferred by options traders to negotiate option trades by communicating in terms of Black-Scholes option implied volatilities rather than option premiums (which change drastically every time the underlying asset price changes due to delta equivalence). The Black-Scholes formula acts effectively as a translation device for options traders for this purpose.

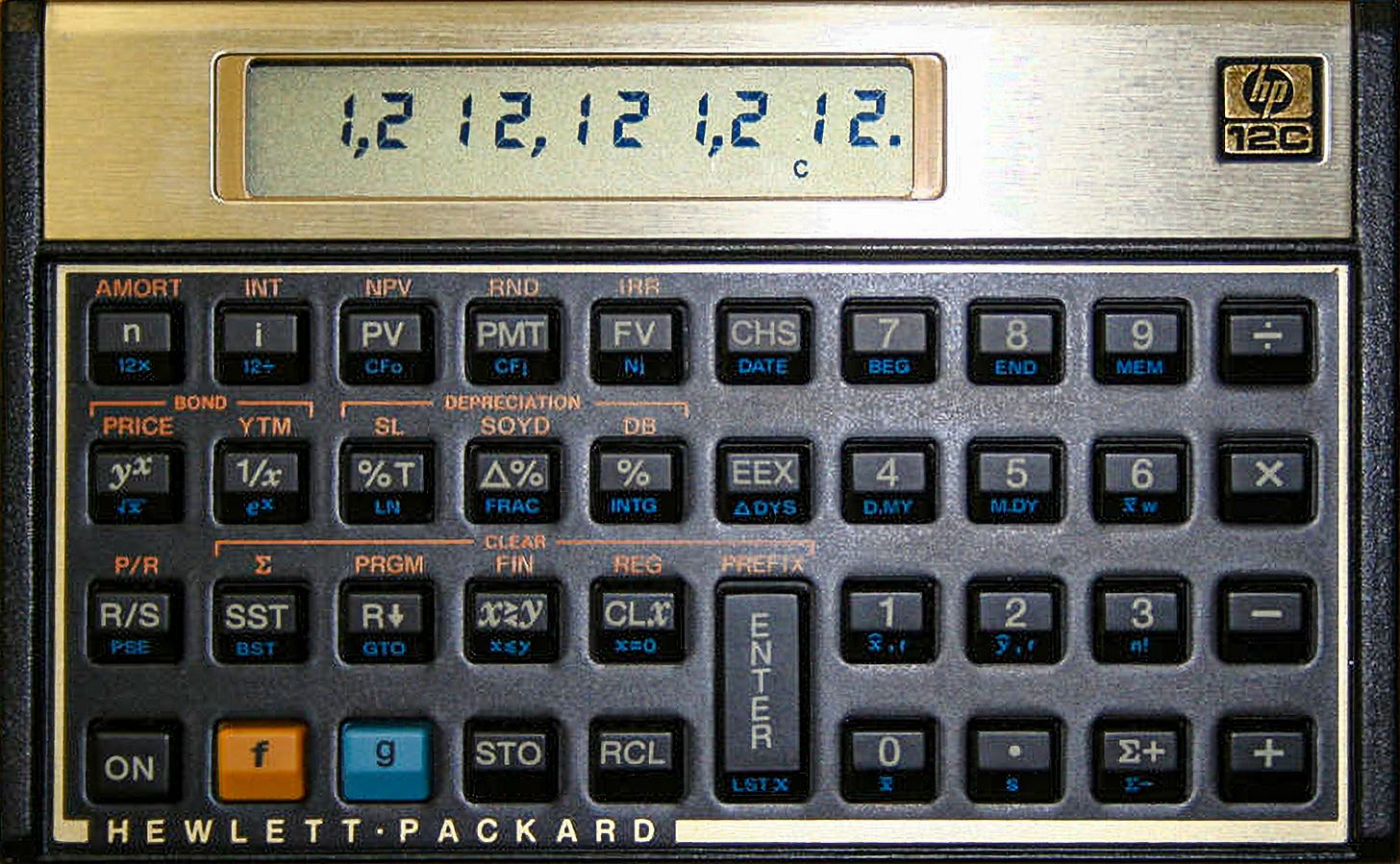

The classic Hewlett-Packard HP12C financial calculator, first introduced in 1981, with Reverse Polish Notation calculation, was the gold standard found on every Wall Street trader and salesperson’s desk on the trading floor for many years, and had the Black-Scholes formula programmed into its limited memory capacity!

That’s it for Part 1, I am trying to keep these posts bite-sized upon feedback from subscribers. In Part 2 I will cover the assumptions behind the Black-Scholes formula and how the real-world markets can deviate from those assumptions, with examples from my trading career! Stay tuned!

For readers who would like to send us a tip and remain free subscribers for now, we have a tip jar at www.buymeacoffee.com/optionsnerds - Thanks for your support!